florida estate tax exemption 2020

The 2020 limit after adjusting for inflation is 1158 million. Application for a Consumers Certificate of Exemption Instructions.

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

The United States government or any of its federal agencies is not required to obtain a Florida Consumers Certificate of Exemption.

. The estimates in the 2020 edition of the Florida Tax Handbook are as accurate as possible given the scope of the document. Florida Voters Approve Two Property Tax-Related Constitutional Amendments. The computation of the tax requires that you state the total value of assets situated in the United States and.

196081 Exemption for certain permanently and totally disabled veterans and for surviving spouses of veterans. FL Stat 341840 2020 341840 Tax exemption 1 The exercise of the powers granted under ss. 1 a A person who on January 1 has the legal title or beneficial title in equity to real property in this state and who in good faith makes the property his or her permanent residence or the permanent residence of another or others legally or naturally.

As a result of recent tax law changes only those who die in 2019 with estates equal to or greater than 114 million must pay the federal estate tax. Federal Estate Tax Explained. A person may be eligible for this exemption if he or she meets the following requirements.

If youre a Florida resident and the total value of your estate. Get information on how the estate tax may apply to your taxable estate at your death. Ad Valorem Tax Exemption Application and Return Not-For-Profit Sewer and Water Company and Not-For-Profit Water and Wastewater Systems N.

196173 Florida Statutes for the 2020 tax roll is. Registration Application for Secondhand Dealers andor Secondary Metals Recycler and instructions. For estates of decedent nonresidents not citizens of the United States the Estate Tax is a tax on the transfer of US-situated property which may include both tangible and intangible assets owned at the decedents date of death.

DOC 60 KB PDF 306 KB DR-501. First Responders Physician Certificate of Total and Permanent Disability Sample. Such point estimates however may.

In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate is. 11400000 in 2019 11580000 in 2020 11700000 in 2021 and 12060000 in 2022. Ad Valorem Tax Exemption Application and Return For Nonprofit Homes for the Aged R.

Application for Self-Accrual Authority Direct Pay Permit Sales and Use Tax. The federal estate tax only applies if the value of the entire estate exceeds 12060000 million 2022 and the tax thats incurred is paid out of. FL Stat 19844 2020 19844 Certain exemptions from inheritance and estate taxesThe tax imposed under the inheritance and estate tax laws of this state in respect to personal property except tangible property having an actual situs in.

3418201-341842 will be in all respects for the benefit of the people of this state for the increase of their commerce welfare and prosperity and for the improvement of their health and living conditions. DOC 84 KB PDF 210 KB Sample. PDF 32KB Fillable PDF 158KB DR-16A.

If youre putting together your Florida estate plan its wise to consider whether youll need to pay a federal estate tax. Exemption for surviving spouses of first responders who die in the line of duty. Real Property Dedicated in Perpetuity for Conservation Exemption Application R.

1121 section 1961975 FS PDF 174 KB DR-504W. No Florida estate tax is due for decedents who died on or after January 1 2005. If you were divorced at the time of.

1 a Any real estate that is owned and used as a homestead by a veteran who was honorably discharged with a service-connected total and permanent. Federal Estate Taxes. The exemption amount will rise to 51 million in 2020 71 million in 2021 91 million in 2022 and is scheduled to match the federal amount in 2023.

1121 sections 1962001 and 1962002 FS PDF 116 KB. The exemption amount will rise to 51 million in 2020 71 million in 2021 91 million in 2022 and is scheduled to match the federal amount in 2023. 196031 Exemption of homesteads.

The estate tax exemption in 2021 is 11700000. Original Application for Homestead and Related Tax Exemptions R. Owns real estate and makes it his or her permanent residence Is age 65 or older Household income does not exceed the income limitation see Form DR-501 and Form DR-501SC see section 1960752 Florida Statutes.

The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. Estates of decedents survived by a spouse may elect to pass any of the decedents unused exemption to the surviving spouse. This election is made on a timely.

The federal government however imposes an estate tax that applies to all United States Citizens. As mentioned Florida does not have a separate inheritance death tax. Florida also has no gift tax.

An attempt has been made to provide point estimates of the fiscal impact for all current exemptions refunds and allowances and potential rate changes. To be eligible for the exemption Florida law requires that political subdivisions obtain a sales tax Consumers Certificate of Exemption Form DR-14 from the Florida Department of Revenue.

Does Florida Have An Inheritance Tax Alper Law

Florida Estate Tax Rules On Estate Inheritance Taxes

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

Ultra Rich Skip Estate Tax And Spark A 50 Collapse In Irs Revenue Bloomberg

Inheritance Tax In Florida The Finity Law Firm

Florida Estate Planning Guide Everything You Need To Know

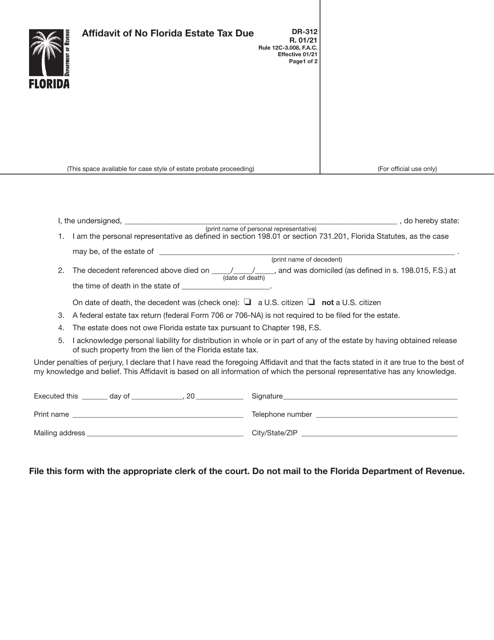

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Increasing Estate Tax Exemption In 2022

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Desantis Delivers An Estate Tax Savings Gift For Floridians

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Will My Florida Estate Be Taxed Nici Law Firm P L Naples Fl

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Florida Property Tax H R Block

Does Florida Have An Inheritance Tax Alper Law

Florida Attorney For Federal Estate Taxes Karp Law Firm

Does Florida Have An Inheritance Tax Alper Law

Relocating To Florida Understanding Estate Taxes On Your Property The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh